Following are our thoughts on a number of issues that have been raised by opponents of the air rights deal:

- If we vote no, will the developers come back with a higher or better offer? It could happen, but we think it’s extremely risky to count on it. At some point the deal will no longer be profitable for the developer. And if we vote down the deal by too large a margin, they may conclude we’ll never accept a deal at any price and stop negotiating with us altogether.

- What about sharing of open space? We read the relevant lawsuits that are trying to change the longstanding practice of allocating specific open space to specific buildings on a combined zoning lot, and we think there is very little risk that the status quo will change in a manner that grants the Bialystoker residents access to Rainbow Park. If you have questions about this, please reach out to us directly as it is too complex to detail here.

- What about Ascend’s track record as a developer? We are selling them air rights, not buying their condos. The problems they had in the past were primarily things like leaks and minor construction defects that affected their buildings’ residents, not their buildings’ neighbors. Developers and builders are also not the same thing. We don’t know who they will use as the general contractor to build their new buildings.

- What about the cantilever? The cantilever will make their building wider, which will affect views. But cantilevers are not exotic or dangerous–they are extremely common in NYC construction and we do not believe they present a structural risk to our property or theirs (have you ever heard of a 30+ story apartment building collapsing?).

- What about the shadows on Building 2? Any new tower will produce new shadows. But when you actually compare the with-air-rights and the as-of-right shadow studies from Ascend’s website (see also the deal opponents’ own shadow study, which is presented more clearly but only shows one time of day), there are only a few hours a day during spring and fall when there is a material difference between the two development plans in how much of Building 2 is in the shade. The rest of the day in the spring/fall, and almost all day in the winter and summer, the two designs produce very similar shadow impacts.

- What about subway crowding and traffic? New housing is being built all over our neighborhood. The difference between an as-of-right development and an air rights development on the Bialystoker site is a tiny drop in the neighborhood’s population bucket. Even the most aggressive estimates of how many people might live at the Bialystoker site would represent less than a 1% increase in daily ridership at the East Broadway subway station–if every resident took the subway every day.

- What about how close the new buildings will be to the F section? A “with air rights” development will be about 60 feet (not 37 feet as stated in a flier we saw) from the nearest corner of the F section. An “as of right” development is likely to be about 90 feet away. For context, the distance between the corner of the J section and the Seward Park Library is about 45 feet, the distance between the F and E section windows that face each other is about 50 feet, the distance between the corner of the A section and the Grand Street Guild building across the street is about 100 feet.

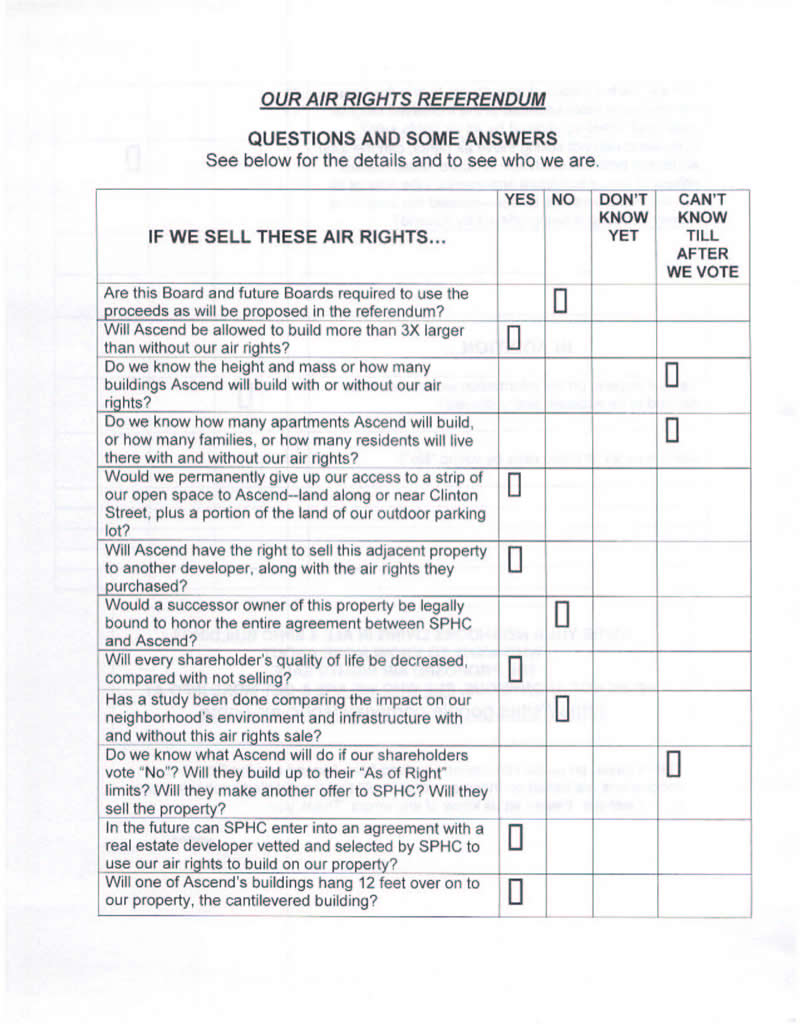

- What if Ascend flips the property to someone else? All of the restrictions we have negotiated (the maximum building envelope, restrictions on construction hours, rooftop cell towers, where they put their garbage, etc.) will be in a Zoning Lot Development Agreement that will be recorded like a deed and “run with the land,” so it will remain binding on whoever owns the property.

- Isn’t it unfair that the maintenance holiday disproportionately benefits people with bigger apartments? People with bigger apartments pay more in maintenance each month. Whether the proceeds of the deal are used for a maintenance holiday or to pay down debt or pay for capital improvements or some other purpose, all of the benefits of a deal will accrue in proportion to how we pay maintenance. It is true that the downside impact of doing a deal is not evenly distributed among apartments. That is unfortunate (we have real sympathy for those neighbors who would lose views or sunlight as a result of a deal–it’s the main reason we considered voting no), but corporate and tax laws largely prevent the Board from applying proceeds other than in proportion to how we pay maintenance.

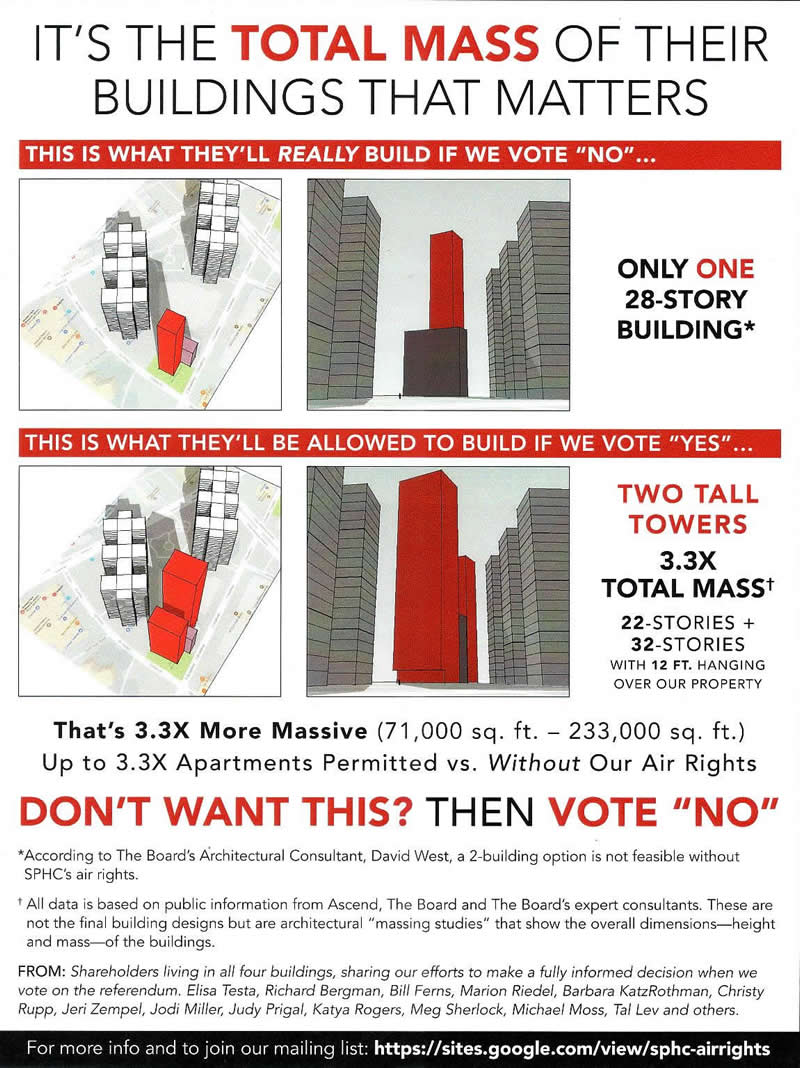

- If we vote no, how do we know what they will build? We don’t know for sure. They could build one building, or two buildings, or the land could sit vacant for quite a few years. Three possible scenarios were detailed in architect David West’s January 22 presentation. But we agree with Mr. West that they would most likely build one approximately 28 story, relatively skinny, building on the eastern lot (where the office building previously stood) in the very near future.

- But won’t we be giving up our future ability to use the air rights? We have three distinct pools of unused air rights: one on the building 1-2 lot, one on the building 3-4 lot, and one on the Apple Bank lot. Air rights generally can’t cross streets. Absent City Council intervention, if we do not sell air rights to the Bialystoker developers, the only other places we could use those particular air rights would be (a) in the front yards of buildings 1 and 2, or (b) to replace buildings 1-2 and/or the garage and Rainbow Park. None of those scenarios seems remotely likely in our lifetimes, so we see this as a one-time chance to monetize our building 1-2 air rights.

- Will our property values decrease? We believe the significant loss of views in a handful of apartments will have an impact on those units’ value, although we don’t believe it will be a large impact. The historical differences in price per square foot between apartments in similar condition with similar layouts but different views are not huge. We do not believe the deal will have an adverse impact on Seward Park Coop property values generally, as our finances will be in significantly better shape when prospective buyers review them, and nearby development has never adversely affected our property values before (to the contrary, bringing more prospective buyers of expensive condos to the neighborhood generally pushes up our property values).

- Won’t our property taxes go up? Property taxes are determined by reference to the rental income reported by “comparable” buildings selected by the city. The deal is therefore unlikely to have a direct impact on our property taxes, unless we upgrade our property to the point where the city decides our “comparable” buildings should be higher end than they are today.

- Could they build something ginormous if “something were to happen” to the landmarked nursing home building? At various informational meetings Board members have mentioned that the contract includes a maximum “building envelope” within which the developers are allowed to build if we approve the deal. We have not seen the details (Board members, please share!), but this should prevent the developers from restacking our air rights in some crazy unexpected way. There is actually more risk of them building something unexpected in an as-of-right scenario if somehow the nursing home building disappeared.