Over the last several years the co-op’s sublet policy has undergone quite a few changes. Sublet fees have been raised several times. Shareholders now give up amenities like parking and storage while they sublet, and drop to the bottom of amenity waiting lists if they sublet for more than two years. At one point the Board passed a rule that would have limited subletting a given apartment to only two or three out of every seven years, but that rule was quickly reversed.

Arguments For/Against Restricting Subletting

Several reasons are typically cited in favor of restricting subletting :

- Many believe that long-term owner-occupiers make better neighbors (they have more incentive to take good care of their apartments and our common spaces, to build relationships with their neighbors, etc.).

- Banks consider owner-occupancy levels when making loans (both loans to the co-op as a whole and loans to individuals buying or refinancing an apartment) and prefer high owner-occupancy.

- Sublet fees provide additional income to the co-op, offsetting the need for higher maintenance charges generally.

- Making subletting less attractive than selling (when a shareholder moves away) can help increase flip tax revenues.

- Reviewing and approving sublet applications takes time away from Management’s and the Board’s other duties.

But there can be problems with being too restrictive:

- While there are some shareholders without a mortgage who earn a tidy profit from subletting their apartments, many who bought in recent years with a mortgage would lose money if subletting at market rates under the current sublet policy.

- Onerous sublet policies can therefore be a hardship for shareholders (and scare away potential buyers) who may have every intention of living here long term, but need flexibility if their circumstances change. For example, shareholders may be temporarily assigned by their employer to another city for a year or two, or might need to move out temporarily to take care of an ailing or disabled family member.

- The more punishing the policy, the more likely less-scrupulous shareholders are to circumvent the policy altogether and sublet illegally. Management has done a pretty good job of rooting out illegal sublets in recent years, but we don’t want to create strong incentives to break the rules.

- While some subtenants are transient, there are many examples in recent years of shareholders who originally arrived as subtenants, and grew to love the community enough to buy an apartment here. At least one former subtenant currently serves on the Board and the author of this post is a former subtenant as well. If no apartments were available to rent, those shareholders might never have been introduced to our community.

Room for Improvement

Few shareholders seem to have serious objections to the amenity-related consequences of subletting. And while a handful believe that allowing indefinite subletting is problematic, so long as the volume of sublets doesn’t get so high as to unduly burden the Board or Management, or threaten owner-occupancy requirements of lenders, we think it should be left alone. That leaves the sublet fee as the main lever available for tinkering.

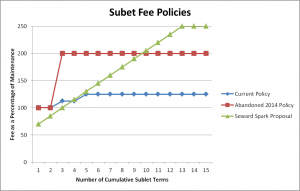

Currently the fee is structured as:

- 100% of maintenance for the first two years of subletting (i.e., a shareholder pays double maintenance for the privilege of subletting)

- 112.5% of maintenance for years 3-4, and

- 125% of maintenance for years 5+.

A year or two ago the Board passed a rule change that would have jumped the fee to 200% for years 3+, but in the face of significant shareholder dissent, they reversed the change before it went into effect. There are still shareholders advocating for significant increases in the sublet fee, primarily because they want to increase sublet fee revenue, but also because some seem to resent the fact that there are shareholders who profit from subletting. These advocates point out that past fee increases did not result in fewer shareholders subletting. We argue, however, that at some point the fee reaches a point of diminishing returns, where the arguments against restrictions on subletting (see above) start to overwhelm the additional revenue wrung out of subletting shareholders. Also, it starts to take on a more punitive and less rational character.

The Proposal

We therefore suggest a sublet fee schedule with a longer, more gradual slope. The goal would be to increase overall sublet fee/flip tax revenue by raising the fees substantially on long-term subletters, while making the policy look less scary to potential buyers and easing the burden on those who intend to come back to the community.

We do not have access to detailed data regarding recent or current sublets, so these numbers are merely suggestions, but the basic idea would be to have a sublet fee that started around 70% of maintenance and increased about 15% for each subsequent sublet term, topping out somewhere around 250% of maintenance. The fee would NOT “reset” with gaps in subletting, but would apply to each additional sublet term that a shareholder initiated during the duration of his or her ownership of an apartment. Name changes and intra-family transactions that are exempt from flip taxes would be treated as a continuation of the same ownership, and sublet history would follow the shareholder in a swap (the same way that first/second-sale flip tax status follows the shareholder).

We do not have access to detailed data regarding recent or current sublets, so these numbers are merely suggestions, but the basic idea would be to have a sublet fee that started around 70% of maintenance and increased about 15% for each subsequent sublet term, topping out somewhere around 250% of maintenance. The fee would NOT “reset” with gaps in subletting, but would apply to each additional sublet term that a shareholder initiated during the duration of his or her ownership of an apartment. Name changes and intra-family transactions that are exempt from flip taxes would be treated as a continuation of the same ownership, and sublet history would follow the shareholder in a swap (the same way that first/second-sale flip tax status follows the shareholder).

To accommodate transition to the new scale:

- For shareholders who are currently subletting at the time the new policy is enacted, fees would stay the same for the remainder of their current sublet term, and increase for their next sublet term to the next step up on the new scale (e.g., those currently at 100% or 112.5% would go to 115%, and those currently at 125% would go to 130% for the next term), and increase an additional 15% each term thereafter.

- For shareholders who previously sublet their apartments but are not subletting at the time the new policy is enacted, fees for their next sublet term would be equal to the greater of 85% of maintenance or the next step on the regular scale above the last sublet fee they paid (e.g., if they last paid 50%, they would pay 85%; if they last paid 112.5%, they would pay 115%), and increase 15% each term thereafter.

Do you think this is a good or bad idea? Why? Please leave your thoughts in the comments below.

I think your proposal is a great idea.

Really, well done, with 2 suggestions:

1. I am wondering why you are starting at 70% instead of at 100%. It would seem prudent to start at a minimum of 100% as that is what the coop has now and increase it from there. It is suggested that you should also show this graph and terms starting at 100% sublet fee.

2. There also needs to be something in writing in regard to consulting with one’s accountant in regard to tax ramifications (based on subletting both in terms of taxes due to subletting additional revenue as well as capital gains ramifications when selling if the owner does not self-occupy in 2 of the previous 5 years of ownership prior to the sale. (see for example: http://www.journalofaccountancy.com/issues/2002/oct/thehomesalegainexclusion.html)

It is prudent to examine other cooperative housing subletting policy, where subletting is allowed. (In our neighborhood, several do not allow the continuous subletting as shown in your chart.)

70% was a pretty arbitrary place to start. I wanted to lower it a bit from 100% as I personally think 100% is very burdensome on people with mortgages, but I didn’t want to lower it so much that it would have a big adverse impact on sublet fee revenue. Unfortunately I don’t have the data available to figure out what the impact would actually be (i.e., what percentage of sublets last more than a year or two), so I took a guess and went with 70%. My hope is that if the board considers this proposal, they will do the necessary analysis and pick a good starting point.

Good point about the tax ramifications! It definitely makes sense to throw a line in the sublet application package reminding prospective sublessors to consult their tax advisers.

My understanding is that most co-ops don’t allow continuous subletting. But in a giant co-op like ours where owner occupancy is very high, I just don’t see what the benefit would be of putting a hard limit on it. Limiting it would adversely impact shareholders who are subletting but genuinely want to come back, would adversely impact sublet fee revenue for the co-op, and would make it harder for families to try out our community as subtenants (my wife and I were subtenants before we became shareholders, and I’m not sure if we would have rented here if we knew we would be forced to move after two or three years). I suppose it might push some first-sale shareholders to sell so we could collect their flip tax, but the sublet fee curve I am proposing would have a similar effect and have the bonus of producing additional revenue for the co-op in the interim.

Continuing from my October 20, 2015 reply, a few additional comments/suggestions are needed to be included/addressed as well:

3. At what point should the coop disallow subletting if it will affect mortgage financing on sales? Given that ” If a building has greater than 15% of their units sublet out by the respective owners / shareholders, the banks will take notice and may give an issue when trying to obtain financing,” (http://ebmg.com/2014/07/what-percentage-of-our-cooperative-or-condominium-building-should-we-allow-to-be-sublet/), the coop needs a policy statement as to its position on this matter to determine exclusions (other than based on one’s application).

4. Perhaps there needs to be a separate mechanism for coop income in place in subletting, just as there is in sales, for original owners and resales, as the former does not carry the mortgage weight as the latter may. This issue should have a re-look based on what the Board passed on October 23, 2015 as to its new fee schedule for subletting starting January 1, 2016.

Regarding the 15% threshold, we’ve never come close to it so I don’t think it’s urgent that the board spend time mow thinking about it. I would hope that Management keeps track of this number and would alert the board to the need to think about the issue if it ever becomes an issue (it might be smart to take a look at it if sublets ever creeped up to 10%, for example, although I don’t think that’s likely with the new sublet policy).

Regarding separate policies for pre/post-reconstitution shareholders, it’s an interesting idea. My own view, however, is that shareholders should generally be treated equally whenever possible. The flip tax is the one big exception. Original shareholders received a massive home equity windfall when the co-op went private, and the first sale flip tax is designed to recoup some of that windfall for the benefit of shareholders who stick around. There are certainly some thematic similarities with sublet fees (subletting is one way to cash in on that equity windfall), but subjecting first sale shareholders to higher sublet fees in addition to the higher flip tax is effectively hitting them twice for the windfall, which I don’t think is particularly fair.

Thank you and a quick comment as to windfall.

With the recent hike in apartment values, as well as for those who have purchased at capped rates, the original owners are not the only ones that have gained tremendously. There are many resales where the profits are also massive.