the need for repairs is no joke

The 2015 Annual Meeting of the Shareholders was one of the most informative Board presentations in recent memory, and also one of the best attended. Current Board President Dave Pass led a quick review of the Board’s activities over the past year and then spent a great deal of time explaining the current state of our physical plant and finances. Mr. Pass, together with General Manager Frank Durant and a panel of outside experts (Greenthal’s financial and engineering experts, and the co-op’s attorney and auditor), made a compelling case for the immediate need for new roofs, continuing brickwork, and a way to pay for it.

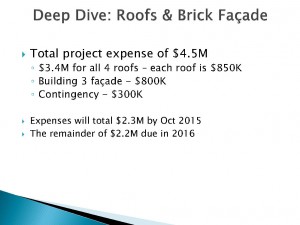

a slide from the Annual Meeting presentation

The state of our co-op’s finances is particularly worrisome. Despite record flip tax and other non-maintenance revenue, we spent at least $3 million more in fiscal years 2013 and 2014 than we brought in.1 This deficit is largely due to the boiler project (a good thing), but we are left with an empty operating account and reserves that (according to the outside experts at the meeting) are likely too low for us to qualify for the most favorable terms when we go to extend or refinance our line of credit, due in May 2016.2 Simultaneously, we are starting crucial capital projects (making sure our bricks don’t fall out of the walls and our roofs don’t leak) that will cost $4.5 million over the next two years, with more to follow.3

Numerous shareholders at the meeting asked why our financial state has been allowed to deteriorate so badly over the last few years, given that the Board has known for years that the capital projects were needed. Mr. Pass did not directly answer, but his and other directors’ comments indicated that there are simply too many Board members who refuse to consider any maintenance increase or assessment.

One shareholder asked if someone would present the “other side” of the argument: what alternatives might be available to a maintenance increase or assessment? When nobody volunteered, another shareholder specifically asked Harold Aranoff and Norma Ramirez, two current Board members who are reputed to be adamantly opposed to increases and assessments, to explain their thinking. Mr. Aranoff would not answer the question, saying only that he was the one who asked for this information to be presented to shareholders. Ms. Ramirez (who currently serves as Assistant Treasurer) said that the issue of maintenance increases had not come up in Board meetings (a statement Mr. Pass immediately refuted).

After the meeting, shareholder Dan Strum circulated a flier saying the meeting was indicative of a “secret agenda” to try to raise maintenance. The flier criticized those who believe increases are necessary because they didn’t push the Board candidates they supported to run on a platform of raising maintenance. Mr. Strum seems to have bought into the myth, frequently pushed by former director Eric Mandelbaum, that there exist shareholders at Seward Park who actually want to pay more maintenance.4 Nobody wants to pay more maintenance than necessary. But with uncontrollable expenses shooting up every year, the money to pay our bills has to come from somewhere. For example, property taxes (which, on their own, account for more than a third of our annual budget) increased an average of $650,000 net of abatements every year for the last five years. Put another way, the average apartment’s share of our annual property tax bill in 2014 was roughly $2,000 more than in 2009.5 Maintenance increases over the same period have not kept up.

Mr. Strum calls raising maintenance an “untenable policy decision” because it’s not popular, and says “the Board needs to revisit some of the revenue-reducing decisions it has made in the past, such as reducing our second-sale flip-tax levels…” This is a bizarre statement. The second sale flip tax was never reduced. It was always 5% since the day the co-op went private.6 And while Mr. Strum and others whose apartments are subject to the first sale flip tax may think raising the second sale flip tax is a clever way to force other people to shoulder a greater share of our collective burden, raising second sale flip taxes would actually hurt everyone for a variety of reasons that are worthy of their own article.7

Nobody wants to pay more maintenance. All of the shareholders who spoke about maintenance increases at the Annual Meeting would almost certainly prefer finding ways to reduce costs and to increase revenues from sources other than shareholders. The 2015 election results make many people optimistic that the next Board will outperform in those areas. But shifting costs onto the backs of select shareholders, or shifting them to future shareholders by running up debts with no plan to pay them back, is not in the “cooperative” spirit. And assuming our costs keep going up faster than our non-shareholder revenues, it’s hard to see how small, regular maintenance increases would be a bad thing compared to the large, unpredictable increases and assessments we’ve been hit with every five or so years to fill the holes left by interim Boards’ deficit spending.

Notes:

- As of 11/30/12, our financial statements showed $3.02MM in our operating account, $8.31MM in reserves, co-op-owned apartments with a cost basis of $660k, and accounts payable of $1.65MM. As of 11/30/14, our financial statements showed $410k in our operating account, $7.76MM in reserves, no co-op owned apartments, and accounts payable of $860k. Financial statements are available on the shareholder portal. (link may require logging into the shareholder portal and then clicking this link a second time) ↩

- At the meeting, Mr. Pass said only about $4MM of our reserves are unrestricted. With an annual budget of roughly $24MM, that equates to about two months of average expenses, and at least two of the outside financial experts at the meeting said that banks typically look for minimum reserves of at least 3-4 months (if not 5-6 months) before lending on their most favorable terms. ↩

- The $4.5MM shown only gets us through 2016. Further brickwork will be needed, and there is no telling if additional unexpected capital projects may arise. In 2014, for example, we had over $1MM in emergency capital repairs. ↩

- The most recent example being the Eric Gazette dated 10/31/14, in which he wrote of four directors who “ardently want to raise your maintenance — unnecessarily…” because “they seem to feel low maintenance…is an embarrassment.” ↩

- Property taxes net of abatements in the years 2009-2014 were $5,084,812, $5,943,702, $6,467,516, $7,390,260, $7,870,171, and $8,426,616. Note that the new accountants presented real estate taxes on a net basis in the 2014 schedules vs. the gross basis presented in prior years. See the co-op’s financial statements. (link may require logging into the shareholder portal and then clicking this link a second time) ↩

- See p.17 of the Plan of Reconstitution. (link may require logging into the shareholder portal and then clicking this link a second time) ↩

- Most notably, Fannie Mae doesn’t buy mortgages secured by apartments with flip taxes over 5%, so raising the second sale flip tax above 5% would make it much harder for new buyers to get mortgages, in turn making it harder for anyone (pre- or post-reconstitution) to sell their apartment. ↩

I am totally for responsible fiscal policy which inevitably will include raising maintenance. Those who represent the “head in the sand” contingent here at Seward Park must be overruled.

Why the writer of this article and the editor of Seward Spark, not even mention what I asked about SPC air rights? Why it is not even considered an extremely highly profitable way to secure the money needed without necessarily raising maintenance or an assessment that we just got through paying for. It is incredible t this shareholder how we are not even attempting to see alternatives to the above mentioned financing all of our Capital Projects. Plus I submitted another way to raise approx. $1million per year from digital ads placed strategically on our property to attract advertisers to pay for the exposure we offer with out property ebing in a HIGH traffic area?

Both valid points. Sales of air rights seem to be pretty much off the table after last year’s referendum. And I suspect a lot of people are going to have adverse reactions to the digital ad idea on aesthetic grounds, although it’s certainly something worth investigating more fully.

In any event, neither of those cash-raising ideas is likely to be relevant to the upcoming capital projects, since the meeting made it sound to me like much of the cost of the capital projects needs to be paid up front, so we need cash now. We probably wouldn’t see any cash from an advertising deal for months after kicking off negotiations, and an air rights deal would take even longer (if it can even get approved).

To further ad to the idea of digital and outdoor display advertising, I have conducted a site analysis with two of the largest outdoor advertising companies (Titan, CBS Outdoor). While the idea seems like a good one, it’s actually not even an option. Our zoning does not allow for placement of billboards or any other type of sign based large scale advertising. Is it possible to seek a variance and spend money on consultants and attorneys to do so? Yes. But the rates and rate of return that we would see on such an endeavor is hardly worth the trade-offs. For anyone interested in this topic I suggest you explore the city’s zoning laws as it relates to for-profit advertising. It’s actually quite stringent, which is why you don’t every building in Manhattan draped with ads or painted with corporate logos. Yes, it exists, but only as a result of zoning which allows it. This is a slightly dated article on the topic, but very relevant if you are interested in learning more: http://www.citylandnyc.org/signs-and-billboards-whats-legal-and-whats-not/. -Eric